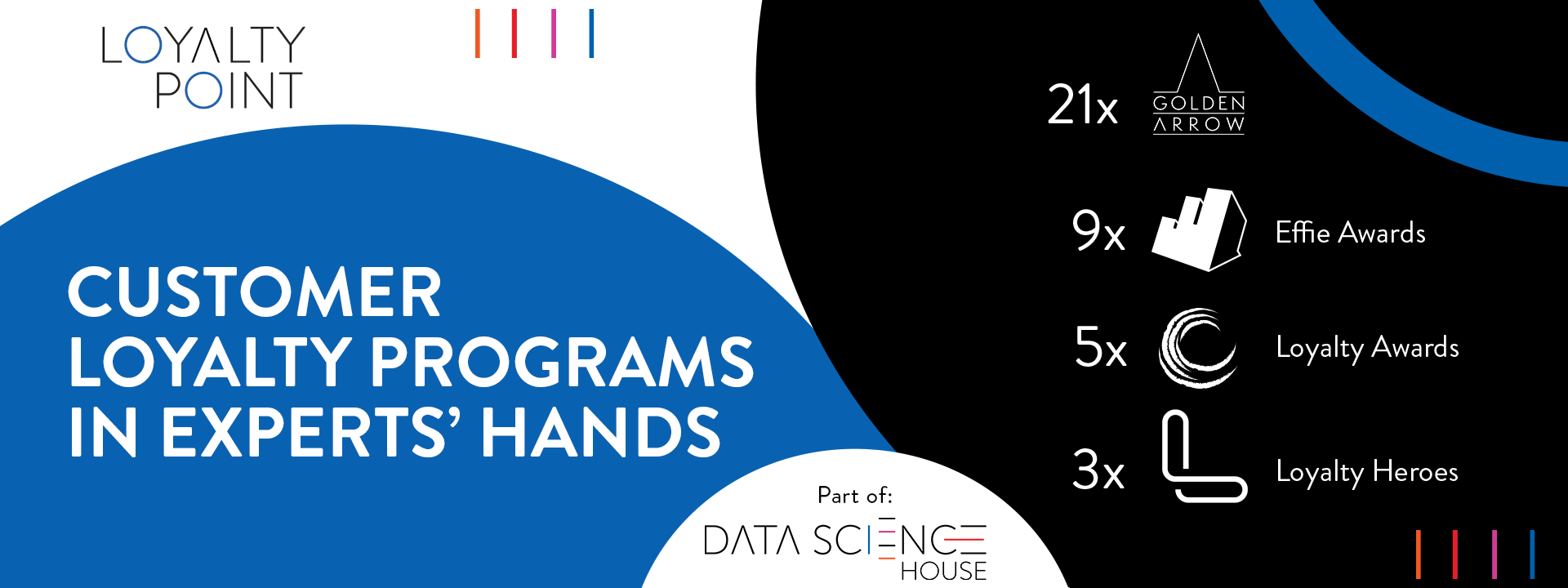

Kompetencje

i doświadczenie, które są wynikiem wdrożeń dziesiątek projektów w wielu branżach.

i sztuczną inteligencję, które umożliwia sprawne wdrożenie oraz elastyczną obsługę programu lojalnościowego.

INTELLIGENCE

w obszarze Data Science, eksploracji

i wizualizacji danych.

prowadzonych działań.

& GOVERNANCE

w tym biznesowe i techniczne integracje baz danych, w szczególności konsumenckich / transakcyjnych.

Case Study

i doświadczeniu, dlatego potrafimy budować długofalowe zaangażowanie konsumentów. Oto podsumowanie efektywności naszych codziennych rozwiązań.

Wdrożenie wysoce wydajnego i elastycznego rozwiązania w modelu no-code

Rynek konsumenckich programów lojalnościowych, szczególnie w branży retail, jest w Polsce bardzo rozbudowany. Główna konkurencja prowadzi już swoje programy lojalnościowe, więc rozwiązanie wdrożone przez Klienta musiało być przynajmniej tak dobre, a docelowo lepsze i bardziej atrakcyjne niż programy dostępne na rynku, znane i lubiane przez konsumentów. Jak wdrożyć program lojalnościowy w modelu no-code?

Długofalowa aktywizacja partnerów handlowych – program lojalnościowy B2B Continental Opony Polska

Program lojalnościowy ContiPartner służy wsparciu sprzedaży B2B. Uczestników.

W 2019 r. wspólnie z ekspertami Continental, postawiliśmy przed sobą duże wyzwanie. Zależało nam na odbudowaniu zaufania Partnerów, dostosowaniu całokształtu Programu do indywidualnych potrzeb i oczekiwań, które zmieniły się od rozpoczęcia Programu oraz zmaksymalizowaniu aktywność Uczestników.

Jak w 7 dni przenieść najlepsze praktyki usługi planowania kuchni do formy on-line?

Pandemia i zamknięcie sklepów stacjonarnych, z dnia na dzień wymusiły na jednej z czołowych sieci retail, zaadaptowanie usługi stacjonarnego planowania kuchni do obsługi online. Brak możliwości bezpośredniego kontaktu z klientem, jak i sprzedaży w sklepach stacjonarnych był ogromnym wyzwaniem dla firmy. Dla nas wyzwaniem było przeniesienie konkretnej usługi, opartej na bezpośrednim kontakcie z projektantem, do formy zdalnej.

Loyalty Point eksperci programów lojalnościowych

na solidnych filarach.

Program lojalnościowy – wszystko, co musisz wiedzieć

Lojalność to najlepsza nagroda

Blog

Value proposition. Jak zmierzyć atrakcyjność programu lojalnościowego wśród konsumentów?

Program lojalnościowy to płynna kompozycja benefitów, która pomaga realizować aktualne cele firmy i skutecznie odpowiadać na działania konkurencji. Składają się na nią mechanika bazowa programu lojalnościowego, oferty specjalne dostępne dla klubowiczów, dodatkowe okazjonalne aktywacje oraz cały wachlarz korzyści emocjonalnych. Pojawia się jednak pytanie, na ile to zwinne podejście do proponowanej klubowiczom wartości, przekłada się na rzeczywistą atrakcyjność programu lojalnościowego.

Program lojalnościowy dawniej i dziś. Jak zarządzać programem lojalnościowym w świetle konsumenckich i technologicznych wyzwań w 2024 roku?

W ostatnich latach krajobraz lojalnościowy znacznie się skomplikował. Odeszliśmy od focusu na administracji i logistyce do koncentracji na analityce i stałej pracy z komunikacją w celu zapewniania personalizowanych doświadczeń. Dzisiaj program lojalnościowy to niemalże projekt IT, którego podstawą jest ciągła nauka potrzeb konsumentów i ofertowo-komunikacyjna odpowiedź na te potrzeby. Jakie kompetencje i narzędzia trzeba zabezpieczyć, aby zwinnie zarządzać programem lojalnościowym w 2024 roku?

Lojalność w branży FMCG. Jak lojalizować klientów?

Świętym Graalem firm z branży FMCG jest znalezienie się na listach zakupowych jak największej liczby konsumentów. Budowanie lojalności w tym segmencie to jednak wymagające wyzwanie. W dzisiejszych czasach kupujący mają tak wiele możliwości wyboru, że coraz trudniej jest wypracować lojalność wobec jednej marki. Dla firm FMCG, ze względu na formę sprzedaży produktów, wyzwanie stanowi dotarcie do klienta. W jaki sposób skutecznie wyróżnić się na półce sklepowej?

Nasz zespół

Po pracy

LOYALTY POINT realizuje projekt przy wsparciu Funduszy Europejskich.

LOYALTY POINT realizuje projekt przy wsparciu Funduszy Europejskich.